The vast majority of Americans need loans to buy homes. After all, a new home typically requires an investment of six figures, and most of us don’t have that much cash sitting in the bank.

When you search for home loans, banks, credit unions and other lenders will offer various interest rates. The higher your credit scores, the lower the rates available to you — and vice versa.

If you have bad credit or little credit, it can make buying a home much more expensive. If you’re searching for a home loan and finding it hard to get good rates, here’s a look at what’s affecting your credit score and how to improve it.

How Credit Scores are Calculated

When lenders pull your credit, they typically look at reports and scores from three companies: Equifax, Experian and TransUnion. While each of these companies calculates credit scores differently, they look at the same general things:

- Length of History: How far back does your credit go? If you have 20 years of great credit, that’s worth more than having five years.

- Payment History: Do you pay your bills on time? Do you have any bills in collections?

- Number of Accounts: How many accounts do you have open?

- Types of Accounts: What types of accounts do you have open? Typically, installments loans (like car loans) look better than revolving debt (credit cards).

- Credit Utilization: How much of the credit available to you are you using? For example, if you have three credit cards with limits of $5,000, $10,000 and $15,000, you have $30,000 of credit available. If balances on the three cards add up to $6,000, you have 20% credit utilization. The lower the percentage the better.

Credit scores are dynamic. That is, they can change month-to-month depending on what happens in your financial life. If you’re dealing with a poor credit score, here are five ways to inch it upward.

1. Check Your Credit First

Start by checking your credit report. First, make sure that the credit report is accurate. If there’s something included that doesn’t look right, file a dispute with the credit reporting companies. Second, take care of late payments or balances that have gone into collections. And, finally, don’t be afraid to negotiate outstanding balances. Lenders will sometimes put you back into good standing even if you pay a lower amount than you owe.

2. Open a Reasonable Number of Accounts

There’s a fine line to walk with credit. You need accounts open so that you can build good credit. But, that said, you don’t want too many accounts open.

If you’re young and you have little credit history, consider taking out a small installment loan. Pay it back over a few months, and suddenly you’ve developed credit.

Also, don’t be fearful of credit cards. If you don’t have one, consider taking one out, putting a small amount on it each month, and paying if off in full before your payment date.

3. Keep Balances Low on Revolving Lines of Credit

Remember credit utilization mentioned above? You’ll want to keep balances on credit cards low so that your credit utilization looks fantastic. For example, if you have the three credit cards with a combined limit of $30,000, a combined balance of $3,000 (10% credit utilization) looks far better than a combined balance of $15,000 (50%).

One trick you can try: Ask your credit card company for a limit increase. You may have a credit card limit of $10,000. With a balance of $3,000, that’s 30% credit utilization. If you ask and receive a limit increase to $12,000, your credit utilization suddenly becomes 25%.

4. Pay Your Bills on Time

To keep a good credit score, do whatever it takes to pay your bills on time. Things happen, though. You may lose your job or experience a medical issue. Be proactive with your creditors. Call and explain what has happened, and you’ll find that they will often work with you to stay current.

5. Get Added as an Authorized User

Here’s one you may not have thought of: Get added as an authorized user on an account held by someone with great credit. Some young people have great credit scores because they were added as authorized users on their parents’ credit cards as teenagers. If you have a loved one in your life who’s willing to help, see if they will add you.

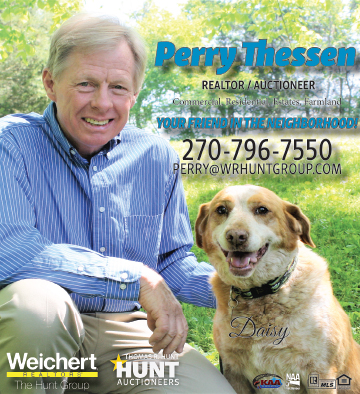

Are you searching for a home loan right now? Whether you have good or bad credit, I’m always here to help. Feel free to email me at pthessen1@gmail.com.

– by Perry Thessen